Imagine your accounting system as a finely tuned instrument, where each note must be played with precision to create a harmonious melody.

Ensuring accuracy in your financial records is akin to mastering this delicate balance.

As you navigate the complexities of maintaining precise accounting, one misstep can throw off the entire composition.

Stay tuned to discover the key strategies that will help you hit all the right notes and orchestrate a flawless financial performance.

Key Takeaways

- Regularly record expenses for accurate financial records.

- Utilize efficient accounting software features for precision.

- Organize receipts and separate expenses for financial clarity.

- Back up data and implement security measures for integrity.

Importance of Recording Every Expense

Regularly recording every expense is crucial for maintaining accurate financial records in accounting systems. Tracking your business expenses meticulously ensures that your financial reports are precise and reliable.

By documenting each expense, you not only adhere to accounting standards but also create a clear picture of your company's financial health. Categorizing these expenses correctly allows for better tax planning, maximizing write-offs, and potentially unlocking various tax deductions and credit opportunities.

Whether you follow the accrual or cash basis accounting method, the thorough recording of expenses is fundamental for both short-term budgeting and long-term financial visibility. Your commitment to accurately recording business expenses not only streamlines your accounting processes but also guarantees that your financial statements reflect the true financial position of your company.

Stay diligent in documenting every expense to uphold the integrity and accuracy of your accounting system.

Significance of Saving Receipts

Organizing and retaining receipts plays a crucial role in maintaining accurate records of business expenses for tax purposes and financial analysis. Saving receipts isn't just a good practice; it's essential for ensuring financial accuracy and compliance with tax regulations.

When it comes to tax filing, the IRS requires businesses to have organized documentation, including receipts, to support their transactions. By categorizing and organizing receipts by year and type of income or expense, you can effectively track and analyze your expenses, making tax filing a smoother process.

Furthermore, keeping receipts, order confirmations, and transaction IDs is vital for precise financial reporting and maintaining an audit trail. Utilizing high-quality accounting software can automate receipt organization, streamlining your bookkeeping process and providing you with a comprehensive overview of your financial situation, ultimately leading to more efficient financial management and accurate tax filing.

Utilizing Accounting Software Effectively

When utilizing accounting software effectively, focus on understanding the software features thoroughly to maximize its capabilities.

Pay attention to data entry tips such as inputting information accurately and consistently to ensure reliable financial records.

Enhance reporting efficiency by utilizing the software's reporting tools to generate precise and insightful financial reports.

Software Features Overview

To effectively utilize accounting software, prioritize selecting a compatible, user-friendly, scalable, and secure system for streamlined financial management. When choosing accounting software, consider the following features:

- Compatibility: Ensure the software integrates well with your existing systems.

- User-Friendly Interface: Opt for intuitive software to ease navigation and training.

- Scalability: Choose a system that can grow with your business needs.

- Security Measures: Prioritize software with robust data protection features.

Selecting software with these characteristics will enhance accuracy, efficiency, and data security within your accounting processes. Remember to update and back up your software regularly to maintain data integrity and compliance.

Data Entry Tips

Enhance your data entry efficiency in accounting software by implementing time-saving techniques and utilizing key features for streamlined financial record-keeping.

Utilize keyboard shortcuts like Ctrl + C to copy and Ctrl + V to paste, speeding up the data entry process.

Take advantage of batch entry features to input multiple transactions simultaneously, reducing manual errors and saving time.

Set default values for recurring transactions to ensure consistency and streamline data entry.

Use import tools to directly upload data from spreadsheets into the accounting software, saving you from manual entry.

Regularly update master data like customer and vendor information to maintain accuracy in your accounting records.

Reporting Efficiency

Maximizing reporting efficiency in accounting software necessitates leveraging its capabilities to streamline financial data analysis and presentation. When utilizing accounting software effectively for financial reporting, consider the following:

- Automate invoicing, billing, and payroll processes to save time and reduce errors.

- Integrate data for real-time updates across all financial aspects, enhancing efficiency.

- Select user-friendly and secure software to improve reporting accuracy and streamline financial management.

- Ensure regular updates and backups to guarantee data safety and compliance with tax laws.

Separating Personal and Business Expenses

When separating personal and business expenses, ensure clear expense categories for accurate tracking.

Maintain meticulous organization of receipts to support financial transparency.

Avoid mingling personal and business transactions to safeguard assets and streamline accounting processes.

Clear Expense Categories

To ensure accurate accounting, it's crucial to clearly separate personal and business expenses for precise expense categorization. When categorizing expenses, consider the following:

- Identifying Deductible Business Expenses: Proper categorization enables easy identification of deductible business expenses for tax purposes.

- Transparency in Financial Reporting: Maintaining separate accounts ensures transparency and simplifies financial reporting.

- Preventing Confusion and Errors: Clear expense categories prevent confusion and errors in financial records.

- Supporting Efficient Budgeting: Accurate expense categorization supports efficient budgeting and financial analysis.

Maintaining Receipt Organization

For accurate and organized accounting records, it's essential to meticulously maintain the separation of personal and business expenses through a systematic approach to receipt organization. By categorizing receipts based on the type of income or expense they represent, you can easily differentiate between personal and business transactions.

Retaining all receipts, including purchases, expenses, and income, is crucial for supporting financial transactions and ensuring transparency in your cash flow. Consider utilizing high-quality accounting software to automate receipt organization and streamline record-keeping processes.

Implementing a system to organize receipts by year will make it easier to track and report financial data accurately, ultimately benefiting your accounting services and overall financial management.

Importance of Data Backups

Data backups play a critical role in safeguarding essential financial data within accounting systems. Here are four key reasons highlighting the importance of data backups:

- Preventing Loss: Data backups prevent the loss of crucial financial information in scenarios like system failures or disasters.

- Ensuring Protection: Regular backups ensure that accounting records are protected and can be restored if needed, maintaining the integrity of financial transactions.

- Enhancing Security: Backing up data to secure cloud storage enhances data security and accessibility, providing a safe repository for sensitive financial data.

- Reducing Errors: Automated backups reduce the risk of human error in maintaining data backups, ensuring accuracy in your accounting system.

Benefits of Outsourcing Accounting Services

Outsourcing accounting services offers you cost-effective solutions, cutting operational expenses by up to 40% and providing access to specialized financial expertise. Increased data security and enhanced accuracy are inherent benefits, allowing you to focus on core business activities while professionals handle accounting tasks efficiently.

Experience improved efficiency and compliance, along with the flexibility to scale accounting services according to your business's evolving needs.

Cost-Effective Accounting Solutions

By leveraging cost-effective accounting solutions through outsourcing accounting services, businesses can significantly reduce operational expenses while gaining access to specialized expertise and advanced technology.

Outsourcing accounting services can reduce costs by up to 40% compared to hiring in-house accountants, providing a substantial financial benefit. Access to specialized expertise in accounting through outsourcing can enhance accuracy and efficiency in handling tax matters.

By outsourcing, businesses can focus on core operations, knowing that accounting tasks are in the hands of professionals. Scalability in accounting services is a key advantage, allowing businesses to adjust services as needed.

Additionally, outsourcing firms utilize advanced technology and tools, ensuring accurate and timely financial reporting for clients.

Expertise in Financial Matters

Shifting the focus from cost-effective solutions to expertise in financial matters, outsourcing accounting services offer businesses access to specialized industry knowledge and advanced technology for more accurate financial analysis and forecasting.

External accounting firms provide expertise in tax compliance, financial reporting, and strategic financial planning. By outsourcing, businesses can enhance accuracy in financial documents and streamline tax preparation processes. Outsourced accountants bring specialized industry knowledge and experience, leading to improved financial analysis and forecasting.

Utilizing external accounting services enables businesses to concentrate on core operations and growth opportunities while ensuring precise financial data. Access to advanced accounting software and technology through outsourcing eliminates the need for costly investments in systems, further enhancing accuracy in financial operations.

Improved Data Security

Enhancing data security in financial operations is crucial for businesses when considering the benefits of outsourcing accounting services. When you entrust your financial information to professional accounting firms, you can rest assured that robust security measures are in place to safeguard your data.

Here are some key reasons why outsourcing accounting services can lead to improved data security:

- Outsourcing reduces the risk of data breaches and cyberattacks.

- Specialized providers use encryption and secure servers to protect financial information.

- Trained professionals ensure data security and confidentiality.

- Compliance with data protection regulations guarantees safe handling of sensitive information.

Creating Daily/Weekly Summaries

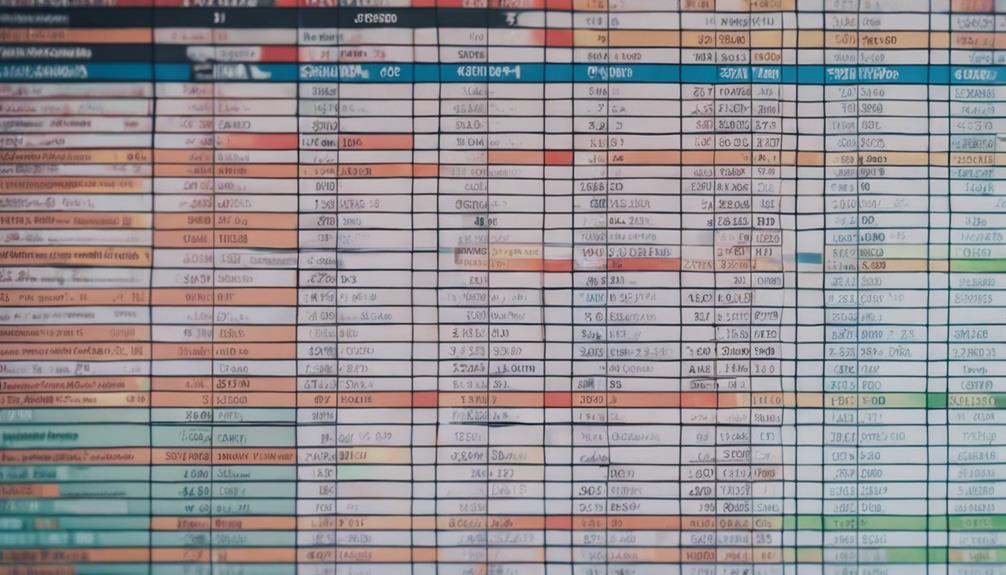

To maintain accurate financial records and ensure timely error detection, creating daily or weekly summaries is essential in accounting systems. These summaries help track financial transactions in real-time, preventing errors and discrepancies. By reviewing these summaries regularly, you can stay organized and up-to-date with your financial information. Furthermore, these summaries aid in maintaining accurate cash flow projections and financial reporting, promoting financial transparency and accountability within your business. To illustrate further, consider the following table showcasing the benefits of creating daily/weekly summaries:

| Benefits of Summaries | |

|---|---|

| Track transactions in real-time | Prevent errors and discrepancies. |

| Timely error detection | Ensure accurate financial records. |

| Aid in cash flow projections | Maintain accurate financial reporting. |

| Organized financial data | Stay up-to-date with financial information. |

| Promote transparency | Enhance accountability within the business. |

Requesting and Keeping All Receipts

Request receipts diligently for each business expenditure to uphold meticulous financial documentation. Keeping track of all receipts is essential to ensure accuracy in your accounting records.

Here are some key practices to consider:

- Retain All Documentation: Save receipts, order confirmations, and transaction IDs to provide comprehensive support for your expenses.

- Detailed Record-Keeping: Detailed receipts play a vital role in precise calculations and effective expense tracking within your accounting system.

- Organize Effectively: Categorize and date receipts systematically for easy reference and retrieval when needed for audits or financial analysis.

- Utilize Automation: Consider using high-quality accounting software that offers receipt tracking features to streamline the process and enhance efficiency.

Implementing Digital Data Redundancy

To ensure the utmost protection of your financial data and prevent any loss, implementing digital data redundancy is paramount in maintaining accurate and secure accounting records. Digital data redundancy involves creating backups of your accounting data daily or more frequently. By setting up automated backups on multiple machines, you can ensure the safety and integrity of your financial information.

Redundancy in digital data storage is crucial as it helps prevent unexpected data loss events that could compromise your financial health. Regular backups play a significant role in guaranteeing the preservation of crucial financial information, safeguarding against any potential data disasters.

Conducting Quarterly Audits

Quarterly audits play a critical role in identifying overlooked errors in financial records, providing reassurance, and ensuring ongoing accuracy in reporting. Professional accountants can detect inaccuracies missed during daily reviews. Conducting audits regularly maintains the integrity of financial data.

Here are some key benefits of conducting quarterly audits:

- Enhancing Financial Performance: By uncovering errors and discrepancies promptly, you can make informed decisions to improve your financial performance and overall business outcomes.

- Empowering Your In-House Accountant: Regular audits support your in-house accountant in their role by providing them with reliable data to work with and helping them stay updated on the financial health of the company.

- Building Stakeholder Confidence: Through consistent audits, you demonstrate a commitment to transparency and accuracy, which can enhance stakeholder trust and confidence in your organization.

- Mitigating Risks: Identifying and addressing potential financial risks early on can help prevent more significant issues down the line, safeguarding your business's stability and reputation.

Emphasizing Accuracy in Employees and Partners

Emphasizing accuracy in employees and partners is crucial for maintaining the integrity of accounting systems and ensuring reliable financial reporting. Employees and partners are key players in upholding accurate accounting practices within an organization. By following established procedures and guidelines, they contribute to the overall precision of financial data. Training programs play a vital role in educating employees about the significance of accuracy in financial reporting and in equipping them with the necessary skills to perform their tasks meticulously.

Regular monitoring and supervision of employees' accounting activities are essential to ensure that accuracy standards are consistently met. Implementing internal controls, such as segregation of duties, can significantly reduce the likelihood of errors and fraudulent activities within the accounting system. Furthermore, collaborating with trustworthy and reliable partners enhances the accuracy of shared financial data and reports.

Maintaining Accurate Accounting Services

For maintaining accuracy in accounting services, it's essential to regularly review and reconcile financial records to promptly catch errors and ensure precise numbers.

To achieve this, consider the following:

- Utilize Accounting Software: Implement accounting software to automate processes and enhance efficiency in maintaining accurate accounting services.

- Conduct Quarterly Audits: Schedule quarterly audits by professional accountants to identify and correct any overlooked errors in financial reporting.

- Receipt Management Practices: Implement proper receipt management practices to ensure all transactions are accurately recorded and accounted for.

- Separate Finances: Differentiate between personal and business finances to enhance accounting accuracy and improve tracking of cash flow for each entity.

Frequently Asked Questions

How Do You Ensure Accuracy in Your Accounting?

To ensure accuracy in your accounting, conduct regular reconciliation checks and attend training seminars. These practices help you spot errors early and stay updated on best practices.

How Do You Ensure Accuracy and Attention to Detail in Your Accounting Work?

To ensure accuracy and attention to detail in your accounting work, focus on quality control and error prevention. Double-check all entries, cross-reference data, and conduct regular audits.

Encourage a meticulous mindset among your team members through training and feedback. Implement strict user permissions and utilize automation features in your accounting software.

How Do You Ensure Accuracy and Precision in Your Bookkeeping Tasks?

Ensuring precision and accuracy in your bookkeeping tasks requires continuous reconciliation and regular audits. By meticulously cross-checking your records and conducting frequent reviews, you can catch any discrepancies or errors early on.

This proactive approach not only enhances the integrity of your financial data but also helps maintain a high level of precision in your accounting system. Remember, attention to detail is key in achieving reliable and accurate bookkeeping results.

How Does Accounting Software Improve Accuracy?

Accounting software enhances accuracy through software integration, streamlining data flow between systems. It automates data entry and calculations, reducing human error. Real-time updates ensure precise financial reporting. Detailed reports aid decision-making based on accurate information.

Conclusion

In the symphony of financial management, achieving accuracy in your accounting system is the key to harmonious success.

Just as a conductor ensures every note is in perfect alignment, meticulous tracking, organization, and review of expenses are essential for precise reporting.

By following best practices, separating personal and business finances like distinct musical instruments, you can orchestrate a masterpiece of financial health and informed decision-making.

So, stay vigilant and keep conducting your accounting operations with precision and care.